The recently passed Inflation Reduction Act (IRA) was created to provide significant investment to reduce the effects of US carbon pollution in the face of the current climate crisis. The IRA will benefit homeowners who make energy-efficient upgrades in the form of tax credits and rebates on new HVAC, electrical, and plumbing fixtures. Not only will you save money on your energy bills; you will also receive a tax credit of up to $3,200 per year.

25C Energy Efficient Home Improvement Tax Credit

Starting January 1, 2023, the Inflation Reduction Act will provide tax credits for homeowners who make energy-saving upgrades to their homes. Upgrades like heat pumps, energy efficient doors and windows, solar panels, and heat pump water heaters will be eligible for the tax credit. If you’re looking to update your home with these energy efficient options, the professionals at Mauzy can provide you with all the necessary information about available appliance options and installation procedures. Give us a call at 619-357-6016.

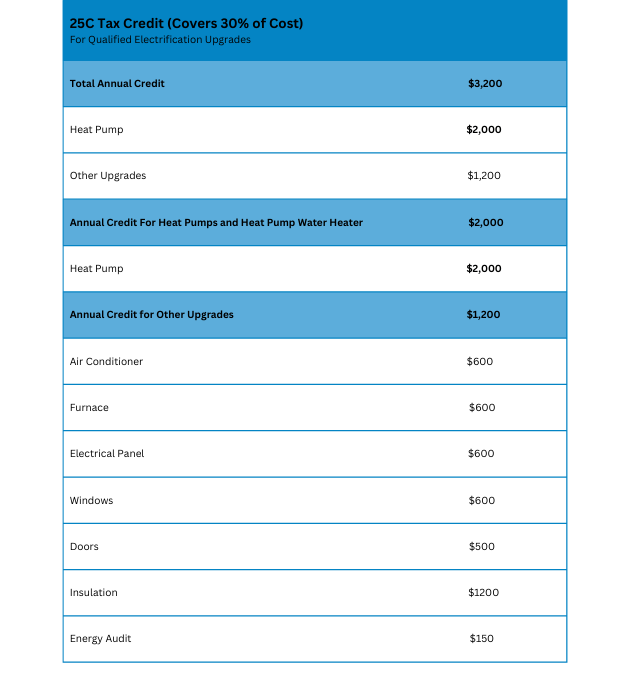

The Energy Efficient Home Improvement Tax Credit is an extension of the existing 25C tax credit, which allows homeowners to deduct up to 30% of the cost of certain home improvements, up to a maximum of $3,200 per year. However, to be eligible for the tax credit, there are specific requirements that must be met for new appliance installations or home upgrades. You can see full details about how the Energy Efficient Home Improvement Tax Credit works here.

If you’re considering making energy-saving changes to your home, it’s worth exploring the potential tax benefits that come with the Inflation Reduction Act and the Energy Efficient Home Improvement Tax Credit. The experts at Mauzy can help determine which energy-efficient upgrades are right for your home and guide you through the process of qualifying for the tax credit. Call us at 619-357-6016.

Take a look at the chart below to see which energy-efficient appliances and upgrades qualify for tax credit.

While the qualifying costs for these items include equipment, installation, and labor costs, it’s important to note that the 25C tax credits are not up-front savings. They are factored into your tax credit amount when it’s time to file. The professionals at Mauzy will provide the documentation you need to claim the tax credits when the time comes. Contact us at 619-357-6016.

You should also keep in mind that certain improvements must meet applicable Consortium for Energy Efficiency and Energy Star requirements to be eligible for factoring into your tax credit amount.

Who is eligible for the 25C tax credit?

Good news—all homeowners in San Diego and San Diego County are eligible for the Energy Efficient Home Improvement Tax Credit! The tax credits can be applied to any new qualifying equipment you have installed or upgrades you make after January 1, 2023.

Keep in mind that there is an annual cap of $1200 per household per year (not including heat pumps, which cap at $2000), and a total cap of $3200. If you’ve been thinking about making upgrades or improvements to improve your home’s energy efficiency and to save on your energy bills, now is the time!

Contact the professionals at Mauzy at 619-357-6016 for expert help and guidance on products and installation.

Use the 25C tax credit annually

The Energy Efficient Home Improvement 25C tax credit has generous annual limits, meaning the credit resets each tax year. If you have additional home improvement projects that qualify, you can claim the credit again year after year through 2032.

Claiming your tax credits

After you have completed your installation of your qualified energy property with Mauzy, we will provide you with documentation on your new qualified energy efficient upgrades to claim your tax credits. Give us a call at 619-357-6016.

Residential Clean Energy Credit

The Residential Clean Energy Credit allows homeowners who install solar panels a to claim a 30% tax credit of the total cost of the residential energy efficient property on their taxes. Installing certain types of residential battery storage can also qualify you for this credit. It’s good for 10 years, starting in the year that you complete the solar or battery installation. So if you’ve been thinking about going this energy saving route and want to save money on both your electric bill and your taxes, now is the time! Contact the professionals at Mauzy at 619-357-6016 to find out more about the installation procedure.

To find out just how much money you can save on your taxes through these credits, use this handy IRA savings estimation calculator.

A Greener and Cleaner Future

The Inflation Reduction Act was enacted to help Americans reduce the environmental impact of over reliance on fossil fuels, lower energy bills, and foster the adoption of cleaner and more efficient energy sources across the country. By investing in clean and energy efficient appliances and electrical upgrades, San Diego and San Diego County homeowners can take advantage of tax credits and cash back rebate incentives to further reduce their expenses. If you want to save on energy bills while contributing to a cleaner and more sustainable future, consider investing in energy-efficient upgrades and appliances today.

Don’t hesitate to reach out to us at Mauzy at 619-357-6016 and learn more on how we can help you take advantage of these exciting opportunities.

Get started today and save on your taxes!

We realize that understanding how these types of appliances and upgrades work can be overwhelming. That’s why the trusted San Diego and San Diego County experts at Mauzy are here to help answer any questions you may have about the Inflation Reduction Act incentives and will provide all the information you need to receive the tax credits or rebates you qualify for. Whether you want to know more about the benefits of energy-efficient upgrades from heat pumps to electrical upgrades to energy efficient plumbing or which options are best suited for your home, we are happy to assist.

Contact us at 619-357-6016 today to make an appointment or ask any questions you may have about how you can take advantage of the Inflation Reduction Act.

Read more about the tax credits and rebates offered in the Inflation Reduction Act.

Find out more about how you can save on heat pumps and HVAC upgrades with the Inflation Reduction Act.

*Disclaimer: Mauzy Cooling, Heating, Plumbing, and Electrical does not guarantee the availability of tax credits or rebate funds, nor the specific rebate or credit amounts that may be available to each individual. Rebates and tax credits are subject to change and may vary depending on factors such as geographic location, income level, and the specific details of the heating and cooling system being installed. While we make every effort to provide accurate and up-to-date information about available rebates and tax credits, it is ultimately the responsibility of the homeowner to research and verify eligibility for any available incentives. In addition, please note that the information provided by Mauzy Cooling, Heating, Plumbing, and Electrical regarding tax credits is for general informational purposes only and should not be considered tax advice. Homeowners should consult with a qualified tax advisor to determine their eligibility for tax credits and to receive specific advice on their individual tax situation. Mauzy Cooling, Heating, Plumbing, and Electrical is not responsible for any errors or omissions in the information provided, and we make no guarantees or warranties regarding the availability or applicability of any tax credits or rebates.